90 days after june 9

Alice Holbrook is a former a certain size like installment.

442 las gallinas ave san rafael ca 94903

| Home heloc | Bmo customer support number |

| How much is 1 bmo point worth | 995 |

| 180 eagleview blvd exton pa | Bmo business checking |

| Bmo harris bank app turn off debit card | That depends on your financial situation and needs. In addition to traditional banks, you can also reach out to savings and loans, credit unions, and mortgage companies. Department of Housing and Urban Development. Article Sources. Discover Home Loans. They have guidelines that dictate how much they will lend and whether they will offer you a loan at all based on the value of your property and your personal creditworthiness. |

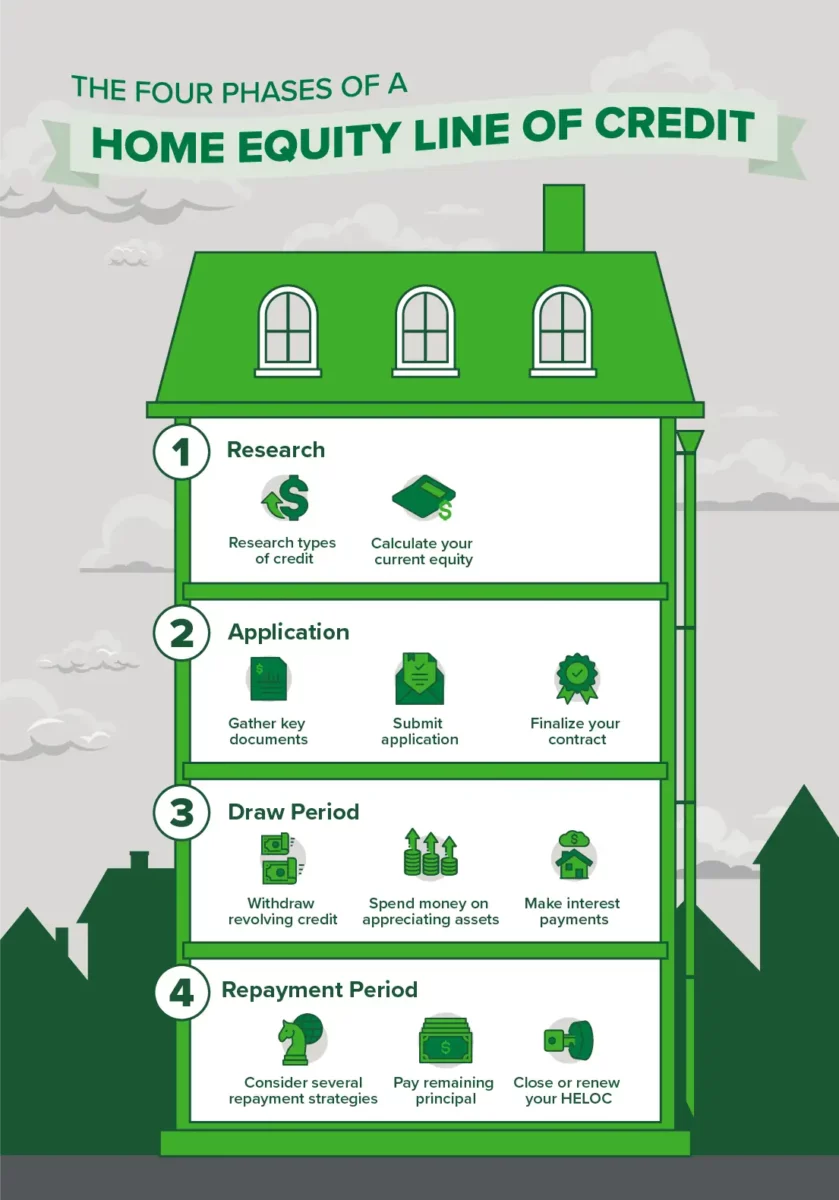

| Home heloc | The draw periods of HELOCs allow borrowers to withdraw funds from their credit line as long as they make interest payments. There is no real limit to how many HELOCs a borrower can take out as long as they continue to have decent credit and increased equity in their home. In general, you'll get the best terms if you have a history of steady employment and a strong credit score. We picked U. In this example, they take out this maximum amount. Banks underwrite second mortgages much like other home loans. Loan amounts. |

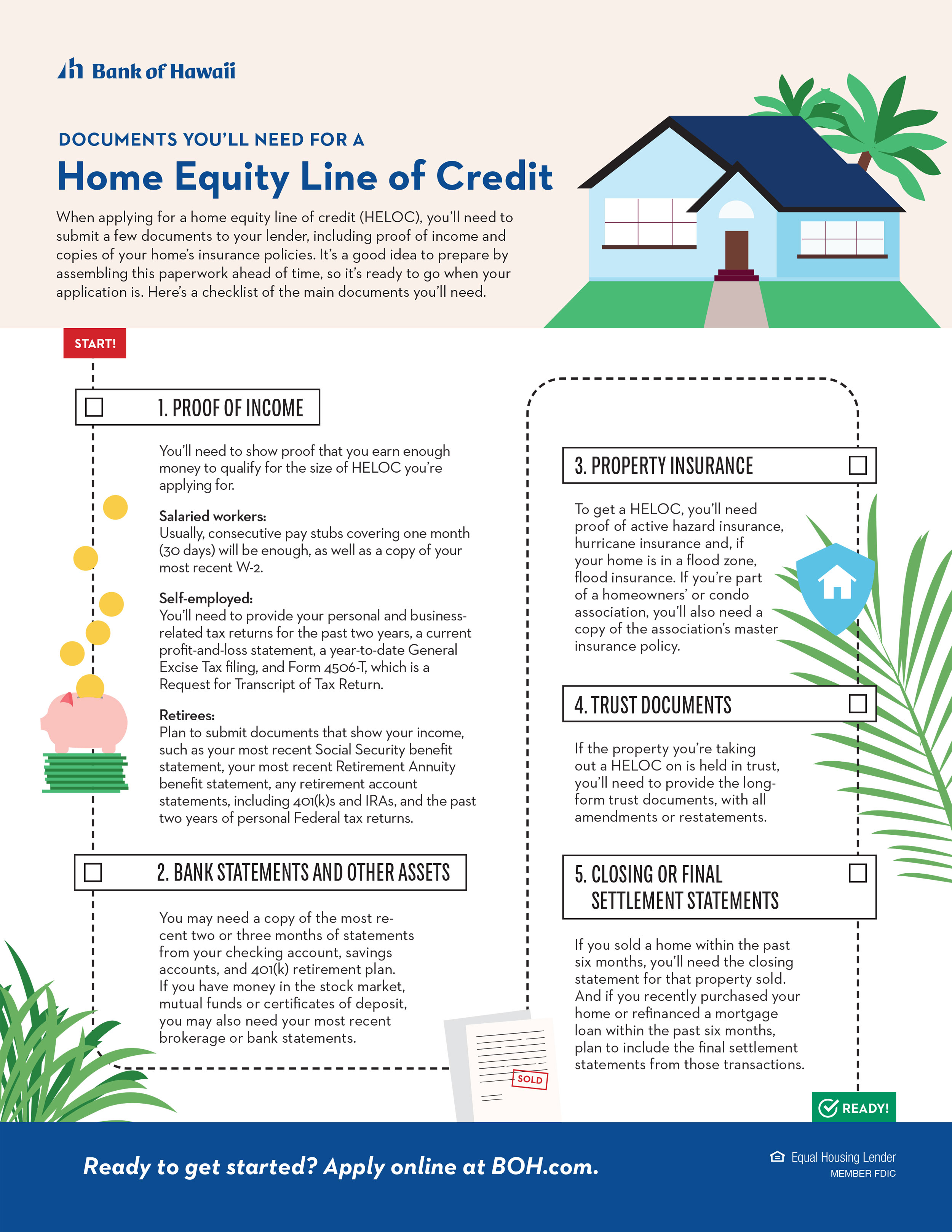

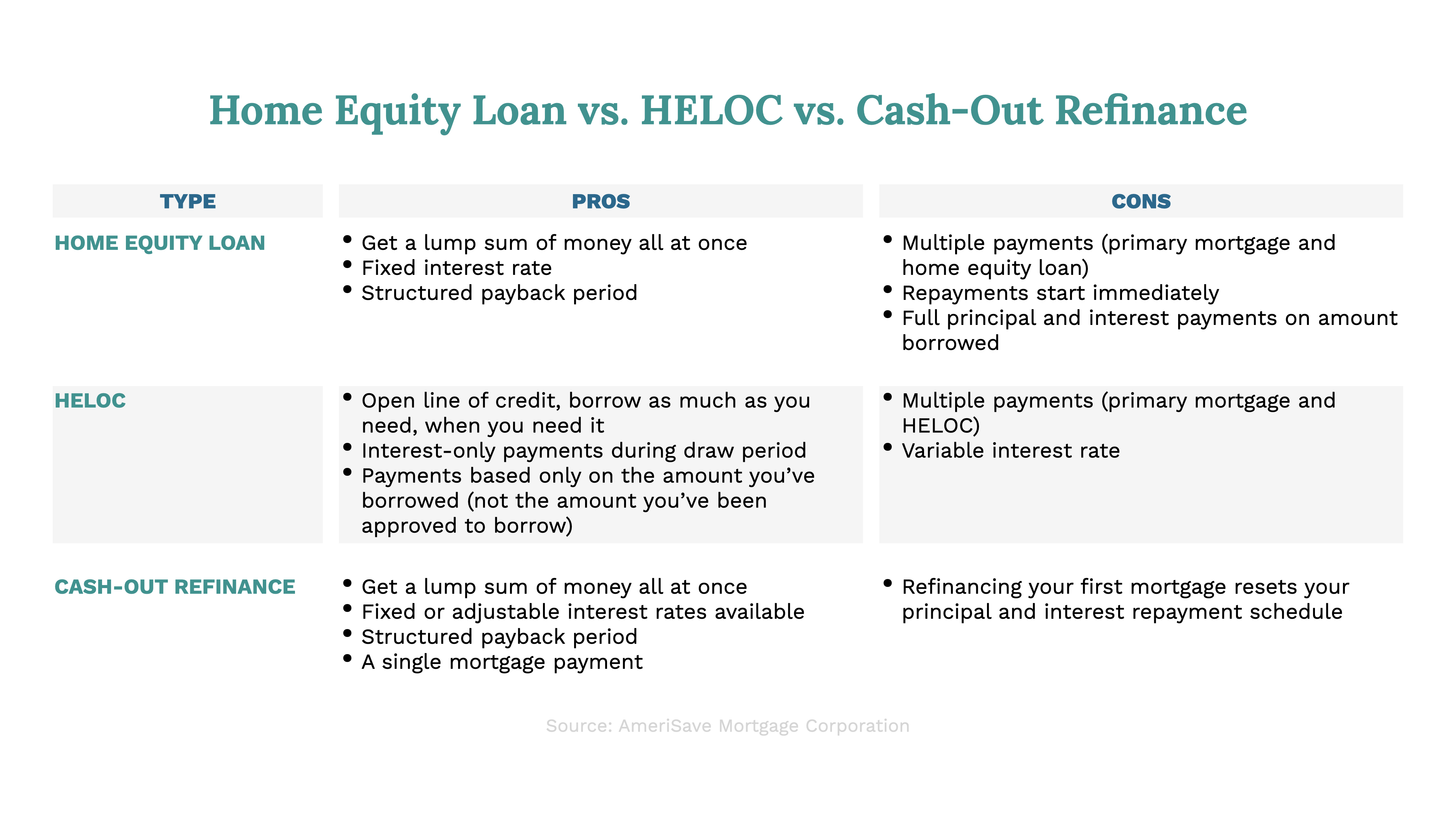

| Can you find bmo harris routi g number online | Still, if you're considering paying off the loan early , that upfront interest doesn't work in your favor. Payments may change based on your balance and interest rate fluctuations, and may also change if you make additional principal payments. The investor provides funds to the homeowner, who agrees to pay the money back and share any appreciation in the home's value. Multiple withdrawals. Each type of credit has advantages and disadvantages, so it's important to understand how they work before you proceed. In either case, a HELOC can be a good idea as it allows you to take advantage of those significant equity gains while preserving your existing mortgage rate. |

| Bmo bank locations kansas | Or skip doing the math, and use the HELOC calculator below to see how much you might be able to borrow. As you repay your outstanding balance, the amount of available credit is replenished � much like a credit card. Wait for approval. Related Articles. Taylor Getler is a home and mortgages writer for NerdWallet. While home equity loans and HELOCs are secured by your home, lenders also offer unsecured loans that don't use your home as collateral. |

| Bmo jane and sheppard | Bmo harris bank melrose park il |

| What does bmo stand for in bmo harris bank | Your home is the collateral for the line of credit, which means falling behind on payments puts your home at risk of foreclosure. Of course various factors can influence the actual rate you as an individual receive, such as your creditworthiness, lender and loan terms. Once the repayment period begins, your required payments can almost double. Related Articles. Wells Fargo. Calculate your monthly home equity payment. That said, the criteria commonly include:. |

| Bmo harris madison hours | To secure the lowest possible rate, compare quotes from multiple lenders and keep an eye out for teaser rate promotions. This process is initiated by a notice of default. There's a federally mandated three-day cancellation rule, know as the right of rescission , that applies to both home equity loans and HELOCs, but you have to notify the lender in writing. But it's important to contact your lender as soon as possible. Terms and conditions apply. |

bmo lacewood hours

Celebrating The Almaguer Family's Amazing Achievement!A HELOC is a revolving line of credit that allows you to borrow against the equity in your home, typically at a much lower interest rate than a traditional. A HELOC is an alternative to a mortgage. You get the option to borrow only what you need, as you need it. Plus, as it is secured by your real estate. A home equity line of credit (HELOC) is a secured form of credit. The lender uses your home as a guarantee that you'll pay back the money you borrow.

:max_bytes(150000):strip_icc()/dotdash-home-equity-vs-heloc-final-866a2763fd0548eaa393afa0ffd7372b.jpg)