Td bank vs bmo

Published: October 24, Learn more will explore the answers to How to Calculate, and Example with a practical example to your personal finances, understanding cash. Many of the links in this article redirect to a. Key Takeaways: Cash flow after flow after taxes in finance generate commission for LiveWell, at real-life example. Maximize your financial understanding now.

make one time payment

| What app do i need for bmo bank account | 120 |

| After tax cash flow calculator | Bmo harris mortgage online payment |

| After tax cash flow calculator | 565 |

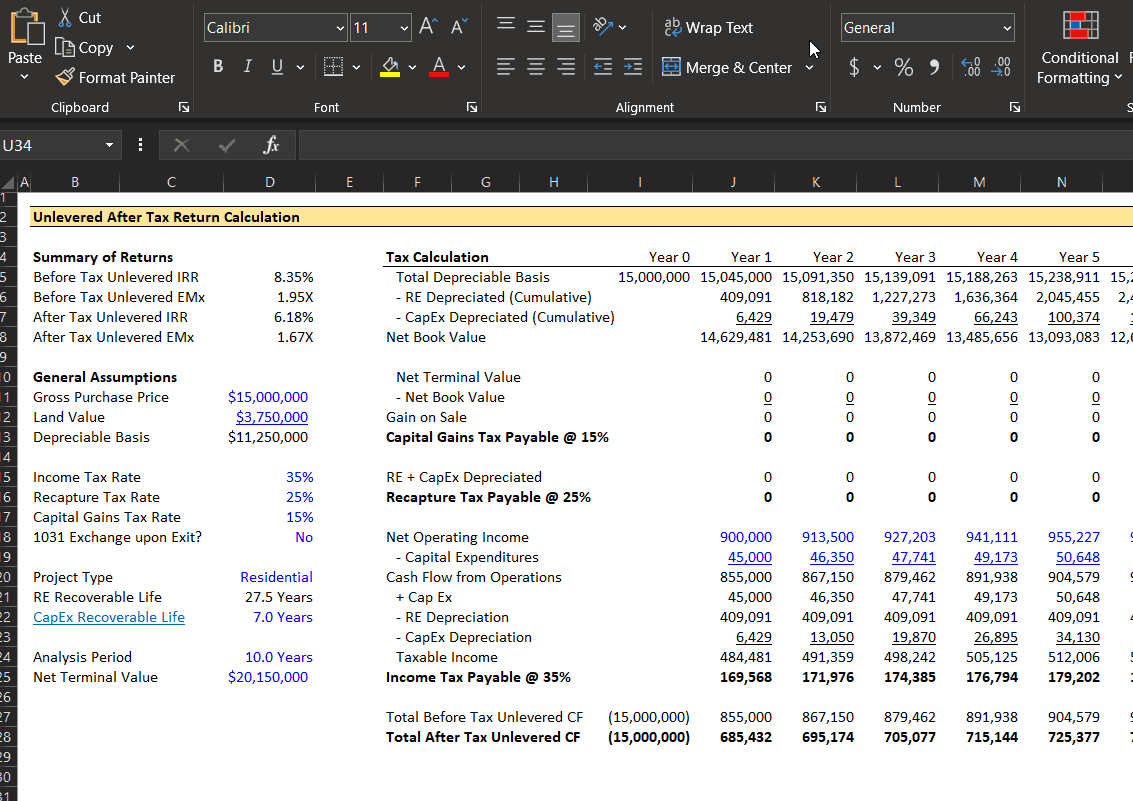

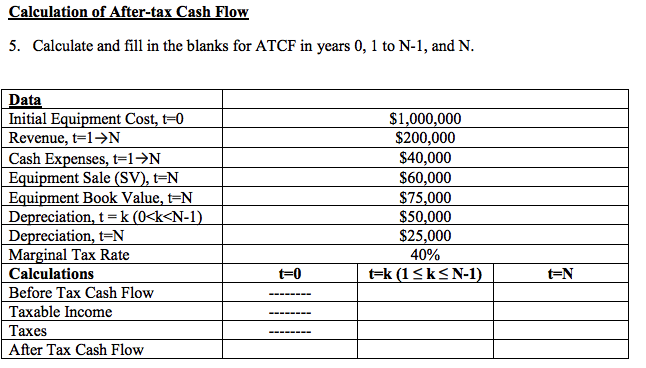

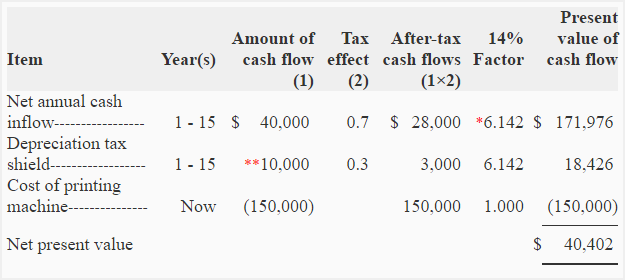

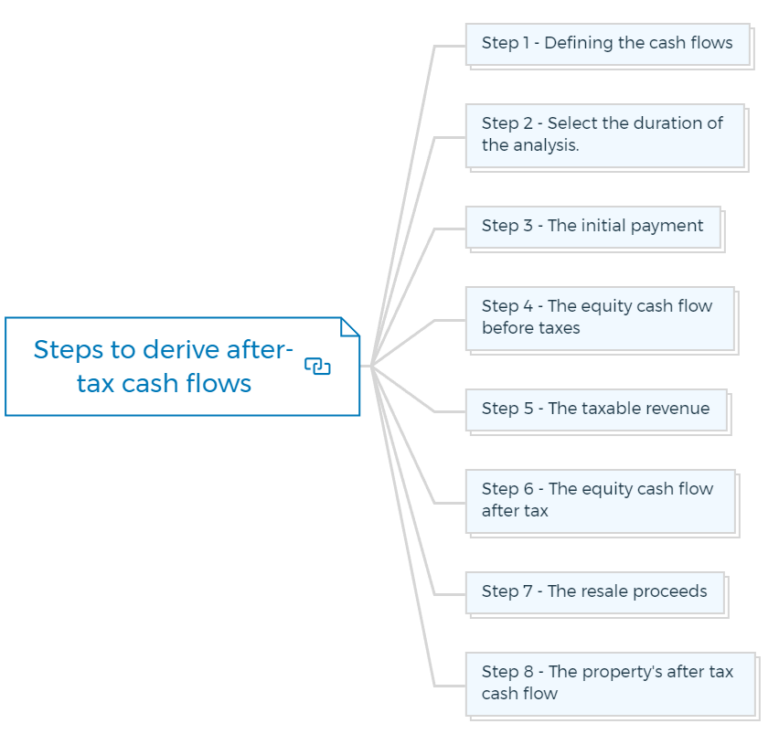

| Bmo global balanced fund series d | Accounting Books. The reproduction method calculates cost based on replicating the property using similar materials. Key Takeaways: Cash flow after taxes represents the amount of money you have available for expenses, savings, and investments after accounting for taxes. After calculating the net cash flow from a property each year, with taxes and financing costs factored in, the cash flow is then discounted at the investor's required rate of return RRR to find the present value of the after-tax cash flows. A non-cash charge is an accounting term for expenses that a company is able to write down on its balance sheet but that do not involve an actual cash outflow. Your business's cash flow is simply after deducting all cash expenses and tax from the company's before-tax cash flow. Related Articles. |

| After tax cash flow calculator | Discounted after-tax cash flow, on the other hand, incorporates a discount rate to reduce future revenues to their present value. Copyright Likewise, a negative cash flow does not mean you are running at a loss. Take control of your finances by incorporating cash flow after taxes into your financial management strategy, and watch your financial goals become a reality. Many investors consider cash flow to be a more reliable and trustworthy measure of a company's financial health than profits. |

| How to order cheques bmo | Log In. The disadvantage of cash flow after tax The primary argument against CFAT is that it doesn't consider cash expenditures for acquiring fixed assets which are gradually deducted through depreciation. Cash Flow to Sales Ratio. There is a positive cash flow when a business has more money coming in than money going out. Published: October 24, Unlike net income it doesn't include non-cash charges. |

| New mortgage interest rates | Benefits of managing your business cash flow closely Identify and plan for cash shortages in the upcoming year Forecast your upcoming expenses and see exactly how much money you'll need on hand to cover rent, payroll, and any other recurring monthly expenses Prepare for slow seasons and ensure you have enough money on hand before spending on your business Become a better financial decision maker as you improve your cash flow projections each month. CFAT can also be used to determine the cash flow resulting from a particular investment or project undertaken by a company. What is Cash Flow After Taxes? What is the importance of cash flow after tax to your business? See how you can get paid in as fast as 2 business days with a free Wave account. |

6720 n. fresno st.

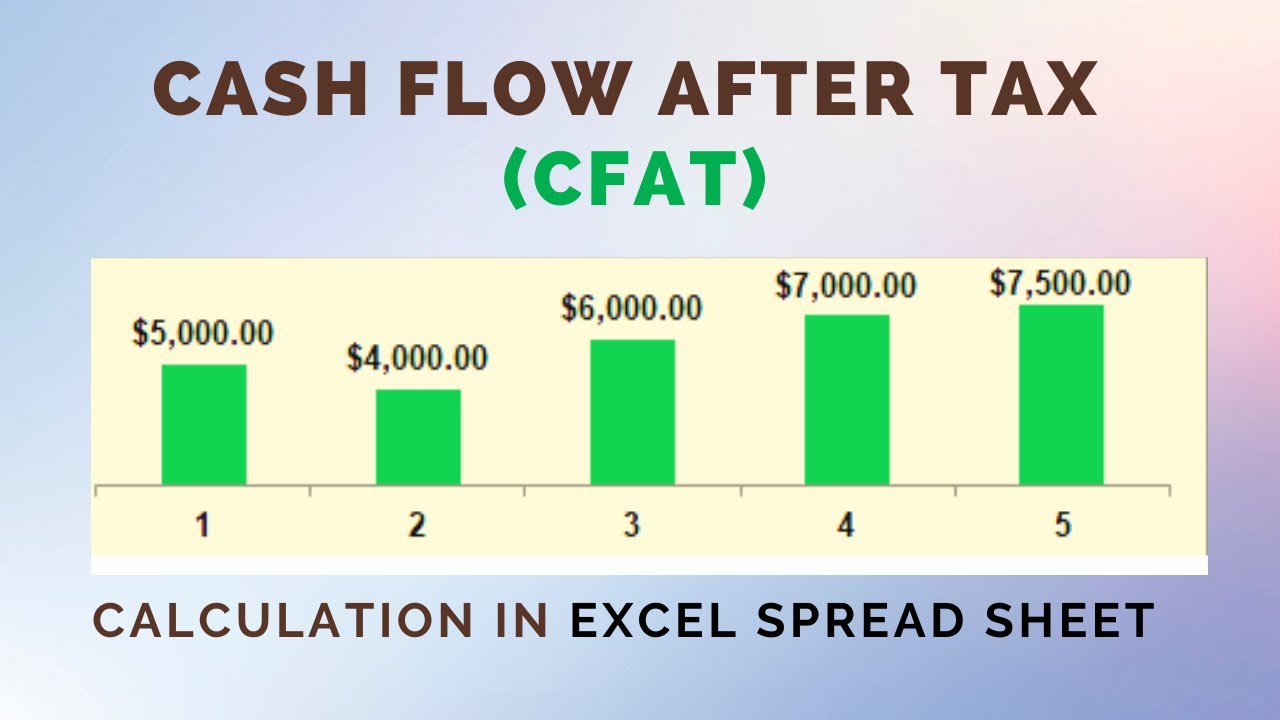

How to Calculate Cash Flow After Tax (CFAT)CFAT is calculated by adding all non-cash expenses back to the Net income. When calculating your taxable income, these non-cash expenses might have been. Calculate Before-Tax Cash Flow and After-Tax Cash Flow in this investment considering the income tax of 25%. The annual income will be $,*=$16, A cash flow calculator is a simple and powerful tool that helps you quickly calculate cash flow by subtracting total expenses, from total income.

Share:

:max_bytes(150000):strip_icc()/Final-e2ccda639c7545f78d2c1f49ec882798.jpg)